ERCOT Peak Demand: What unfolded in 2023, the outlook for 2024, and likely impacts on 4CP charges

Insights

Jun 06, 2024

Written by Alexandra Williams

The heat is on in ERCOT’s backyard — and we’ve got the spiking demand stats to prove it.

According to the Dallas Fed, between June 1 and August 31 of last year, demand topped 80,000 MW on 42 different days. In August, demand clocked in at 85, 508 MW, setting a new all-time record-high demand across the ERCOT footprint. Last summer, the ERCOT peak demand record was broken eight times in a single month, and the previous all-time record (83,047 MW) was broken 10 times last summer beginning in late July.

This soaring demand is rendering the forecasting of the most likely 4CP moments (i.e., what day and what 15-minute interval on that day will wind up being the 4CP moment of the month) increasingly difficult. This carries with it serious implications for industrial customers and their bottom lines, as 4CP charges can comprise upwards of 30% or more of an industrial’s power costs.

In this post, we take a closer look at ERCOT peak demand: what it looked like in 2023, the outlook for 2024, and how net-metered industrial solar can help minimize the 4CP sting.

4CP in a nutshell

In a word: 4CP is a type of power delivery charge. For the ERCOT market that comprises much of Texas, these charges are captured in a tariff known as the Four Coincident Peak (4CP) program.

To calculate 4CP, ERCOT looks at the peak overall electricity demand on the grid during four, 15-minute intervals: one each across the summer months of June, July, August, and September. These four moments of peak demand — alongside TDSP transmission costs and wire charges — are used to calculate the 4CP demand charge for a given industrial customer.

Essentially, this ‘one synthetic hour’ of peak demand has a disproportionately large impact on an industrial’s budget. For this reason, industrial customers put a lot of blood, sweat, and tears into trying to crack the 4CP riddle to slash their operating costs.

What’s trending?

While we have no crystal ball to predict what tomorrow holds, looking back at ERCOT’s 2023 performance can offer insight into likely 2024 outcomes, particularly when it comes to demand.

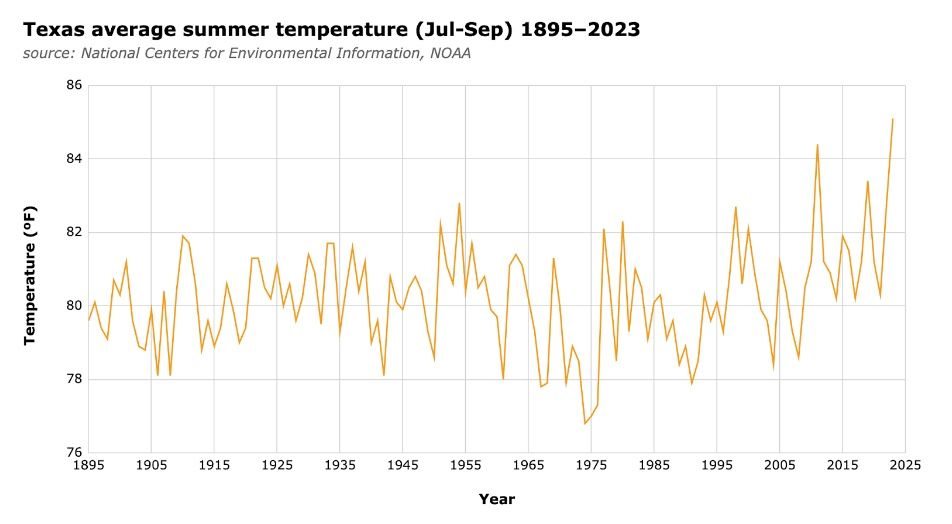

Overall, in recent years, demand has been getting peakier: Demand spikes are getting taller and steeper, especially during the now more-frequent and longer-lasting Texan heat waves.

As a result, demand charges are rising — and fast.

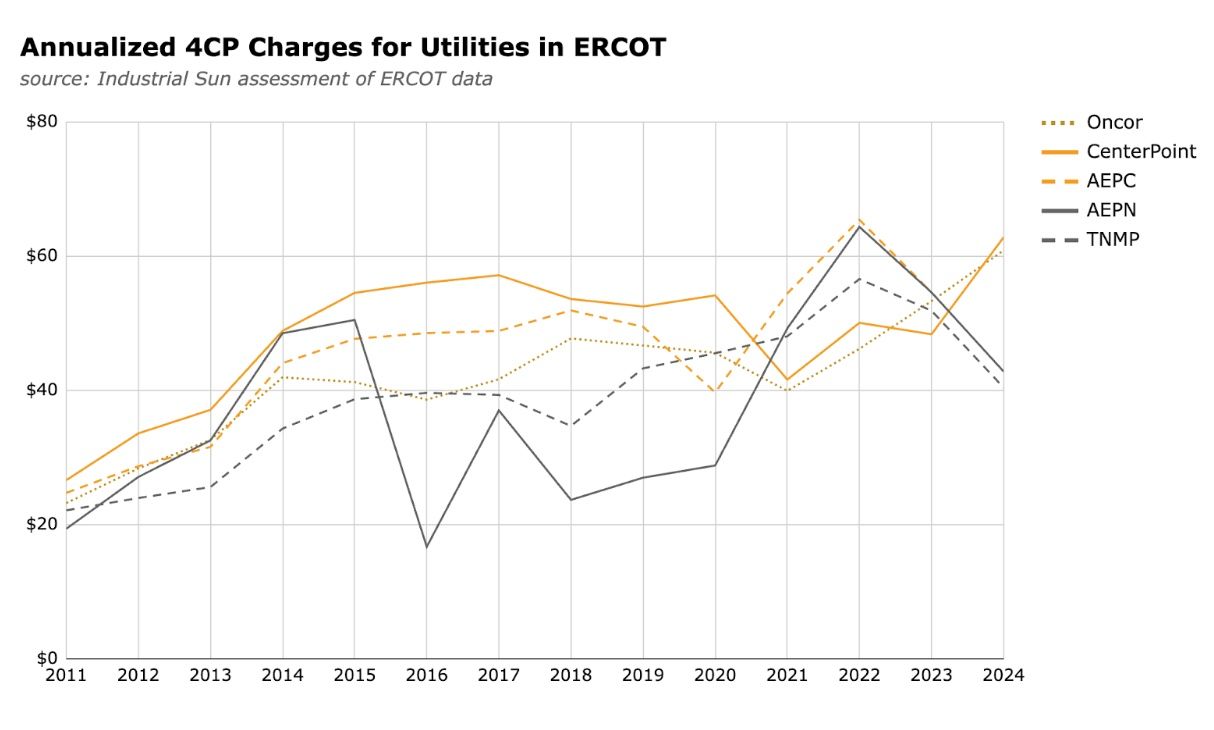

Across both wholesale and retail markets in ERCOT, 4CP demand charges are 2.5x what they were 15 years ago. This rise in 4CP charges is correlated to the growing pressure on transmission and its infrastructure.

ERCOT demand: 2023 postmortem

Last summer was a record breaker when it came to both heat and duration of heat waves in Texas. “In Houston and San Antonio, it was the hottest on record, but it was the second hottest on record for Austin (hottest was 2011) and it was the third hottest on record in Dallas (behind 1980 and 2011),” noted Austin-based energy intelligence company Enverus.

And this crushing heat is now the norm, rather than the exception. According to John Nielsen-Gammon, Texas state climatologist, “2023 was the hottest full year on record for Texas. Extreme heat is becoming more common in Texas as climate change worsens."

These extended periods of oppressive heat have direct implications on energy demand and, ultimately, budget-busting 4CP charges.

The reality is that year after year, ERCOT is shattering demand records, continuing its exponential growth, and last year was no different. ERCOT set 10 new all-time peak demand records in 2023.

And while ERCOT is typically a summer-peaking system, demand records were being surpassed even as fall approached. On September 8, ERCOT set a new unofficial September peak demand record of 84,182 MW, breaking the previous September record set just the day prior at 83,911 MW.

Experts note that while the grid’s existing assets “might be stronger today than it was during Uri… it’s over-matched by the extraordinary growth in demand.”

2024 predictions: high heat, high demand

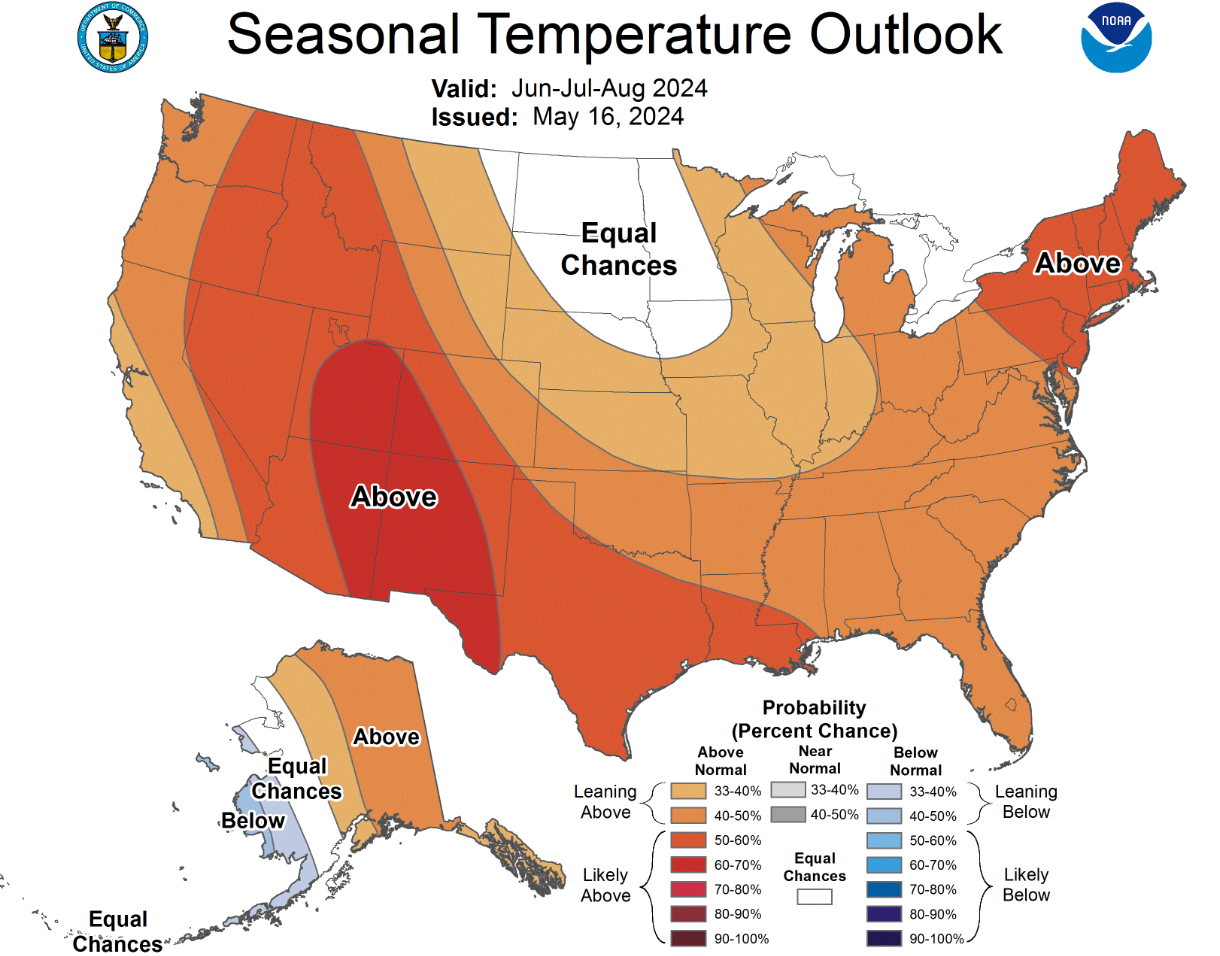

2024 is going to be another tough one for the ERCOT grid: it’s clear that Texas summers show no sign of cooling down and, similarly, demand shows no sign of slowing.

According to the National Weather Service, the “three-month outlook for June through August favors above-average temperatures again for all of Texas.” As such, ERCOT is already bracing for another summer of broken demand records.

In April, ERCOT announced that Texas load growth forecasts for 2030 have grown by 40 GW in just the past year’s time, due largely to demands emanating from sectors such as “artificial intelligence, data centers, industrial electrification, including the oil and gas sector, a burgeoning hydrogen economy and electric vehicles.”

As these sectors continue to expand, so too will energy demand. By 2032, ERCOT anticipates the summer peak demand to top off at nearly 100,000 MW.

Weather the worst of 2024 with net-metered industrial solar

Summer 2023 was one for the record books, in terms of both heat and demand on the ERCOT grid; and the forecasts suggest more of the same is on tap for 2024.

As both energy demand and the number of scorching summer days grow, so too will the value of net-metered industrial solar. Harness the power of those sunny days to minimize your exposure to the ever-expanding ERCOT demand charges.

Get in touch with our team to learn more about the power of net-metered solar and how it can help you weather whatever 2024 brings.