Sweltering Heat and Swelling Energy Prices: Why Texas Industrials Need to Insulate Their All-in Power Costs

Insights

Aug 23, 2023

Written by Alexandra Williams

Summer 2023 has been an absolute scorcher — on track to be the hottest year on record. These blazing temps carry implications for soaring energy demand, not to mention soaring energy prices. Nowhere is this more evident than in Texas’s ERCOT electricity market.

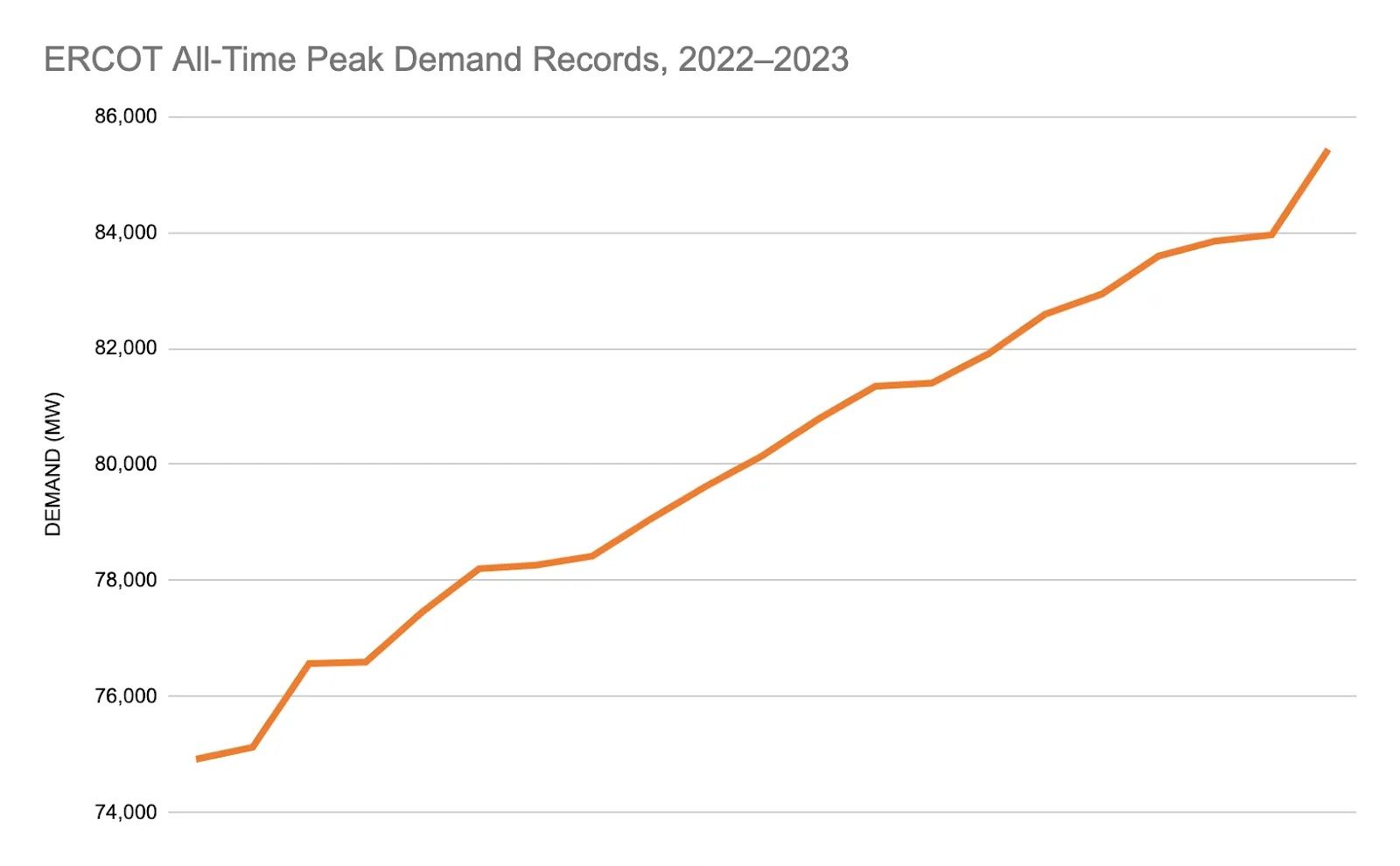

So far this year, ERCOT has set a new all-time peak demand record 10 times. This now totals a whopping 21 (!) all-time records set across the two-year period spanning 2022 and 2023. The current record stands at 85,435 MW, up 10 GW since early 2022. And ERCOT could break its own record yet again later this week, with a Weather Watch issued as more high temperatures threaten to strain the grid.

With record heat and record demand, energy price spikes follow

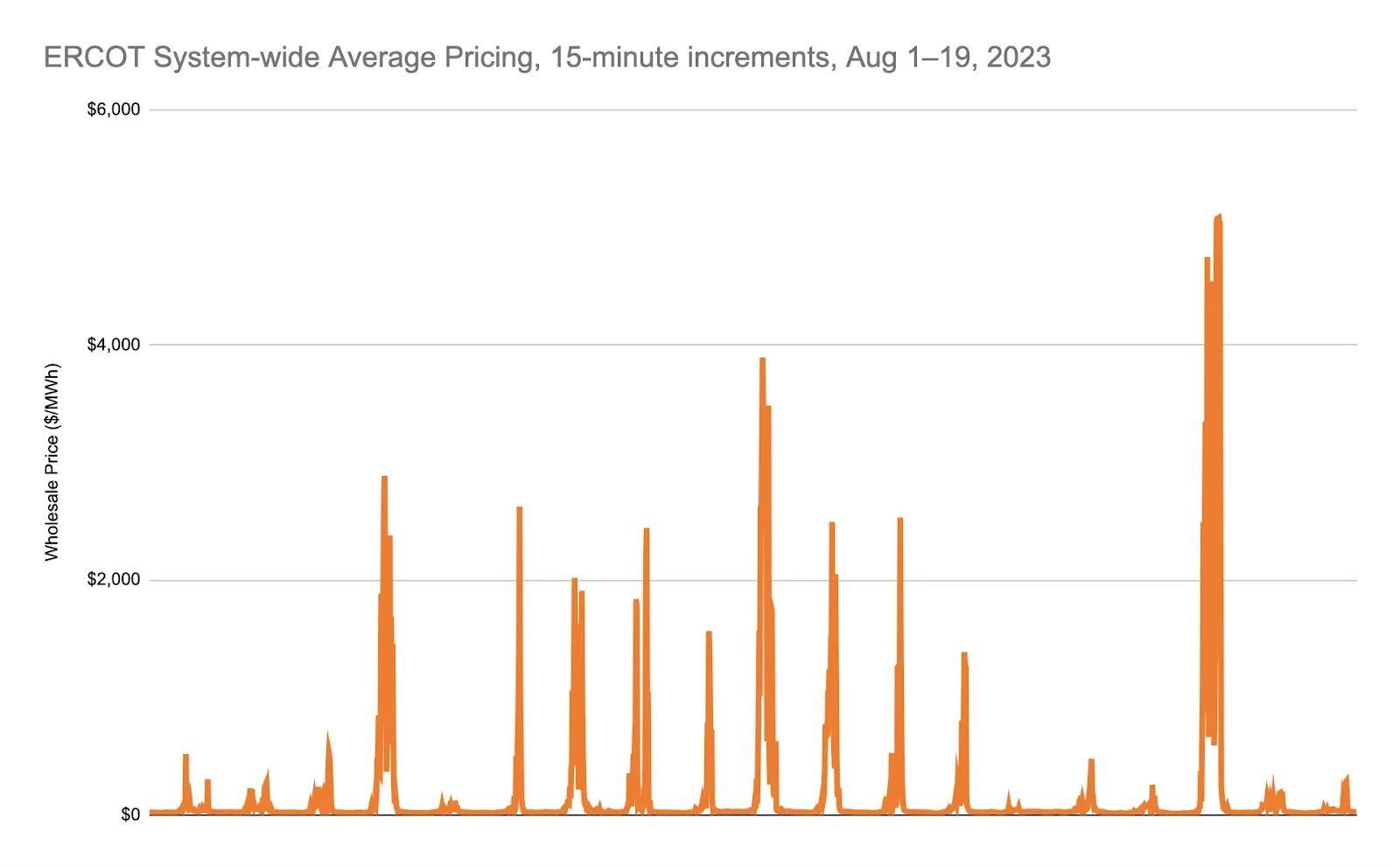

Record-setting demand isn’t just straining the Texas grid and challenging ERCOT grid operators. It’s also impacting electricity prices, sometimes significantly.

Last year the average market price across ERCOT was $62/MWh to ~$74/MWh, depending on the source of the analysis. Yet during recent heat waves, the system-wide average in ERCOT’s real-time market (RTM) has surged to nearly $5,000/MWh, a truly staggering number.

And although 2022’s average pricing seems tame compared to the spikes we’ve seen this summer, even last year’s numbers are double to triple what ERCOT has seen 2014 through 2020, when pricing sat in the $25 to $40/MWh range.

Clearly, a new normal has arrived in ERCOT, with implications for customers and their all-in power costs.

Now and later: Texas heat impacting industrial power bills in both the short and long term

All of this boils down to Texas heat waves and record-setting demand impacting industrial customers’ all-in power bills in two distinct ways.

- Immediate impacts on energy charges: As we’ve seen, record-setting electricity demand during summer heat waves often translates to massive wholesale power price spikes in both the real-time and day-ahead electricity markets. Industrials that pay wholesale for their electricity are going to feel that pain immediately.

- Delayed impacts on demand charges: Second, this summer’s record-setting demand is going to also mean big adjustments for next year’s 4CP demand charges. Industrials need to take steps now to insulate themselves from what’s coming. That’s because this year’s peak demand hours form the basis for the 4CP demand charges that will be calculated for 2024 power bills.

Keeping cool with net-metered industrial solar

Already since 2010, renewables have saved ERCOT customers writ large an estimated $31.5 billion in wholesale electricity costs, including $11 billion in 2022 alone.

But for industrial customers in particular, net-metered industrial solar offers an even better value proposition: affordable, predictable electricity that mitigates energy charges via power purchase agreement (PPA), uniquely structured to also virtually eliminate the hefty demand charges that can plague all-in power costs.

If the summers of 2022 and 2023 are any indication, this means that net-metered industrial solar helps keep those all-in power costs metaphorically cool at a time when wholesale market prices and volatility are red hot.

Alex Williams is the Vice President of Origination at Industrial Sun. Find her on LinkedIn.